On This Page

Lawyer:

Calculate Property Settlement Deadlines

Scenario

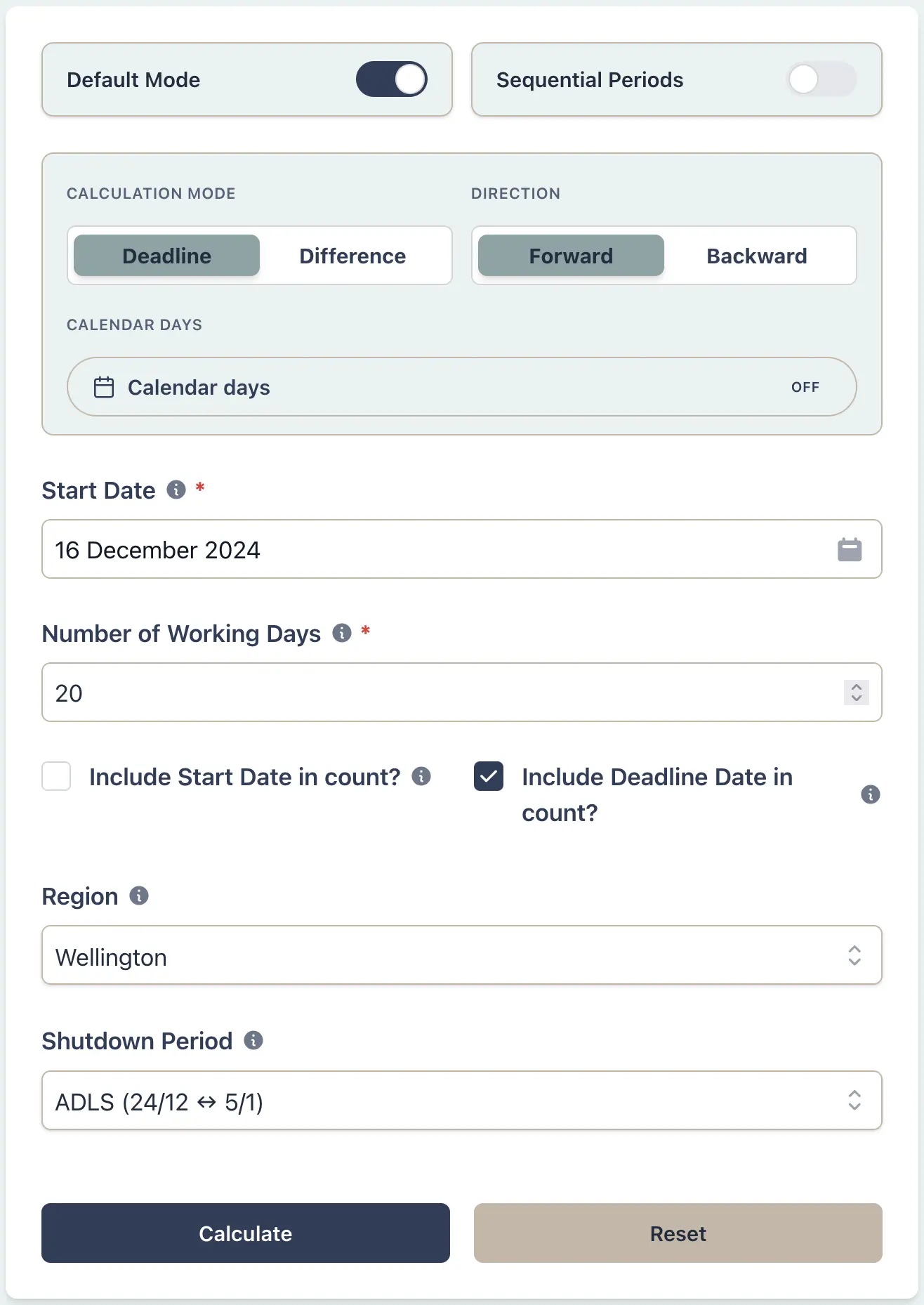

As a lawyer, you are handling a property settlement for a house in Lower Hutt under the ADLS agreement form. The agreement becomes unconditional on 16 December 2024, and settlement is due 20 working days after this date. You must calculate the settlement date accurately, taking into account weekends, public holidays, the Wellington Anniversary day, and the ADLS shutdown period during Christmas/New Year. Providing the correct settlement date is crucial for your client, the bank, and other stakeholders involved in the transaction.

Example Workflow

Result Example

If the agreement becomes unconditional on 16 December 2024, and considering the 20 working day settlement period, the ADLS shutdown period, Wellington Anniversary, and other public holidays, the settlement date would be 27 January 2025.

Why This Matters

- •Ensure accurate settlement dates for property transactions

- •Account for ADLS shutdown period and regional anniversaries

- •Provide certainty for clients, banks, and other stakeholders

- •Eliminate calculation errors and save time

Real Estate Agent:

Release the Deposit After 10 Working Days

Scenario

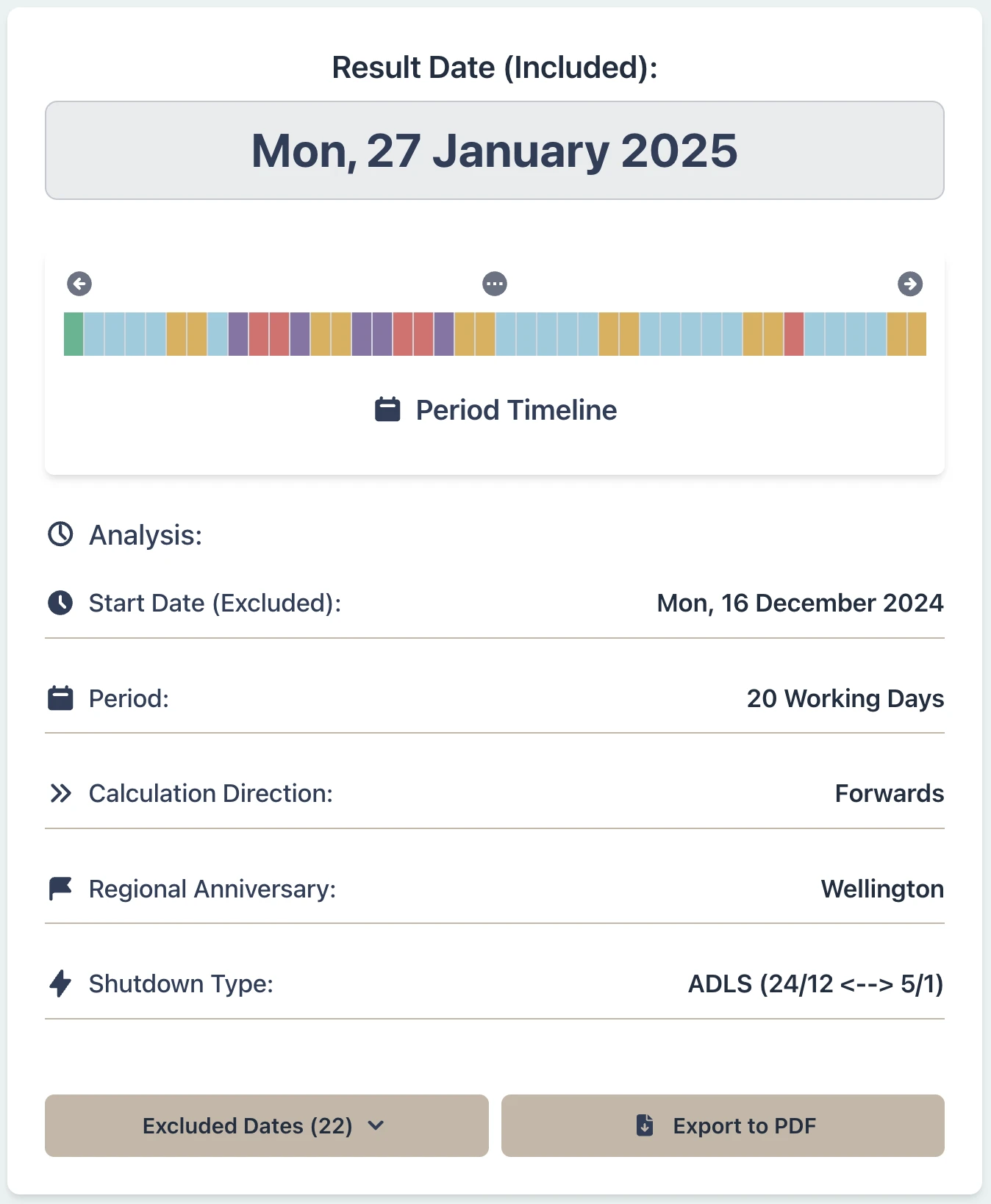

As a real estate agent, you are holding a deposit in trust as part of a property transaction under the ADLS agreement form. You received the deposit on 13 December 2024 when the agreement became unconditional. The Real Estate Agents Act requires you to hold the deposit for a period of 10 working days after receiving the deposit. You must calculate this period accurately, taking into account weekends, public holidays, and any applicable summer shutdown period. You must also pay attention to the wording of the Act which requires you to hold the deposit for 10 working days after receiving it.

Example Workflow

Result Example

If the deposit is received on 13 December 2024, and considering the statutory holidays (noting the definition of working days under the Legislation Act does not account for regional anniversaries), and the Legislative shutdown period, the deadline for releasing the deposit would be 8 January 2025. It is important to note that the agent must hold the deposit for 10 working days. This means the agent can't release it until they have held it for the full 10 working days after receiving it.

Why This Matters

- •Ensure compliance with the Real Estate Agents Act regarding deposit handling

- •Avoid penalties or disputes by adhering to statutory deadlines

- •Provide clear and precise timelines for clients, fostering trust and transparency

- •Document the calculation for your records in case of future inquiries

Company Director:

Calculate Notice Periods for Shareholder Meetings

Scenario

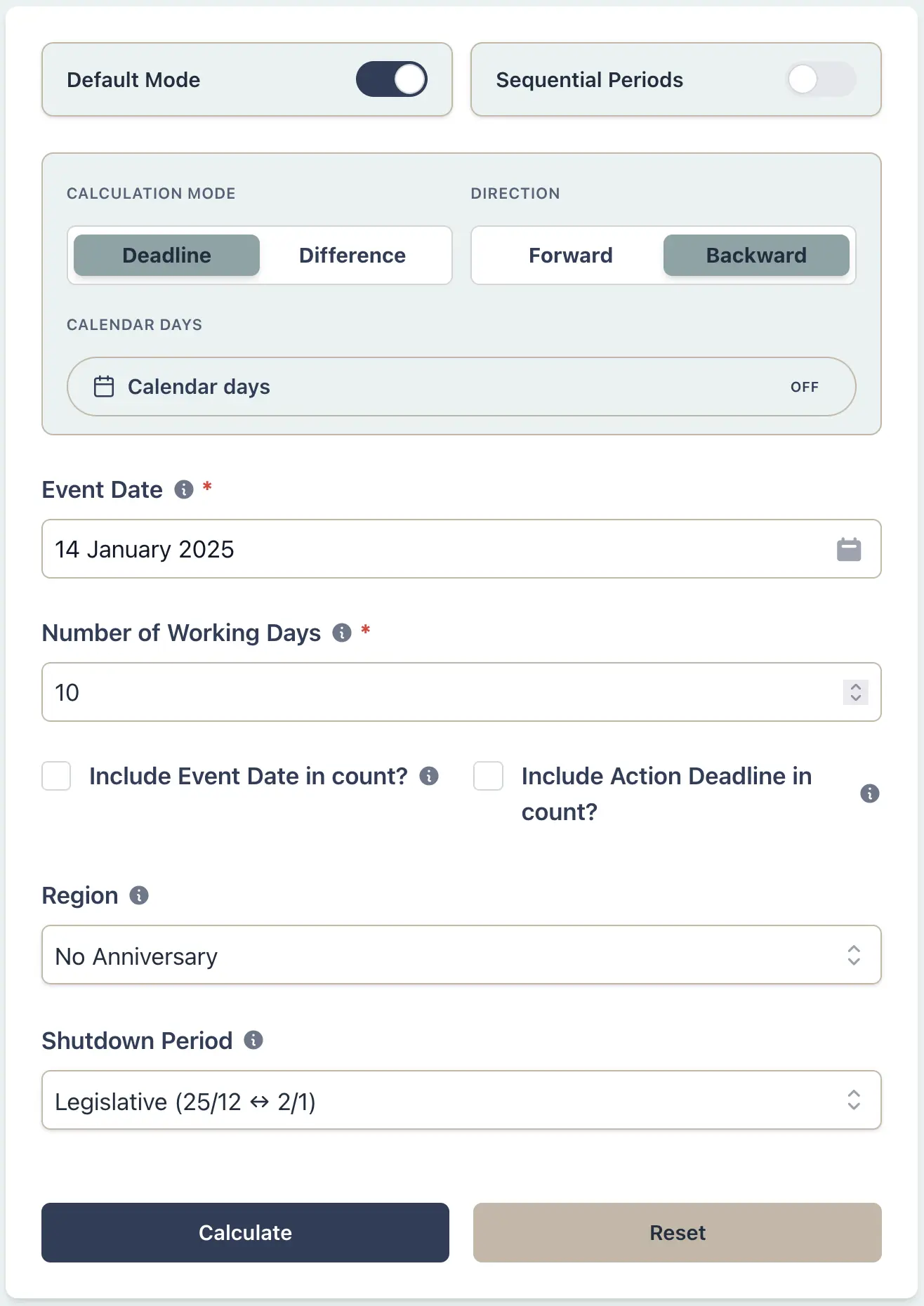

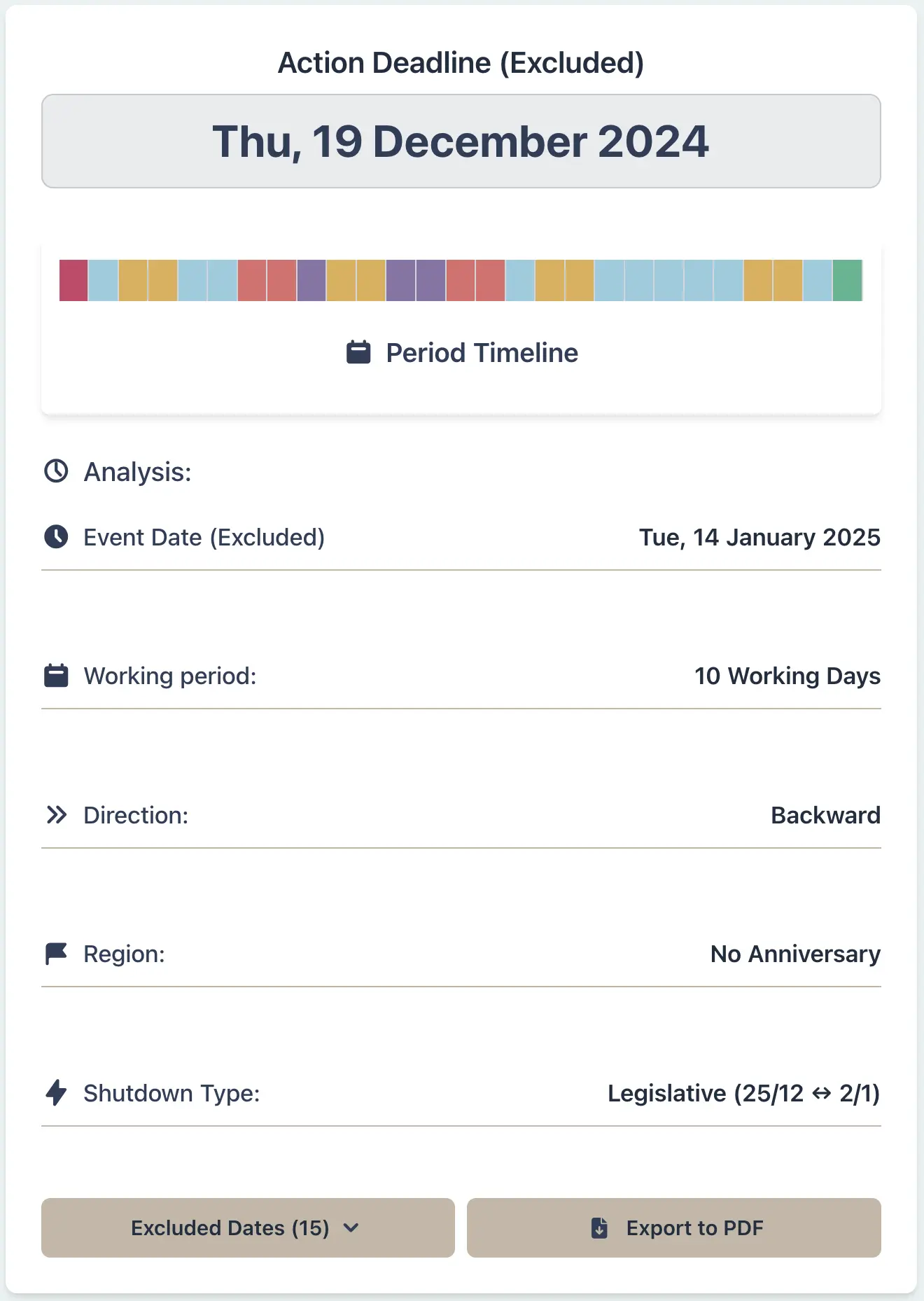

A company director needs to call a shareholders' meeting to pass a resolution approving a conditional transaction. The condition requires shareholder approval by 15 January 2025. To meet this deadline, the meeting is scheduled for 14 January 2025. Under the Companies Act, shareholders must receive notice of the meeting not less than 10 working days before the meeting date. The director must calculate the latest date to serve the notice, considering that regional anniversaries are not relevant to the Companies Act definition of working days, and taking into account the legislative summer shutdown period (25 December to 2 January).

Example Workflow

Result Example

If the meeting is set for 14 January 2025, the latest date to serve the notice of meeting, accounting for the legislative summer shutdown period and public holidays, would be 19 December 2024.

Why This Matters

- •Ensure compliance with the Companies Act notice requirements for shareholder meetings

- •Avoid invalidating the meeting by serving notice too late

- •Provide certainty and transparency to shareholders regarding meeting dates and resolutions

- •Maintain proper corporate governance and documentation

HR Manager:

Track Employee Leave Balances with Precision

Scenario

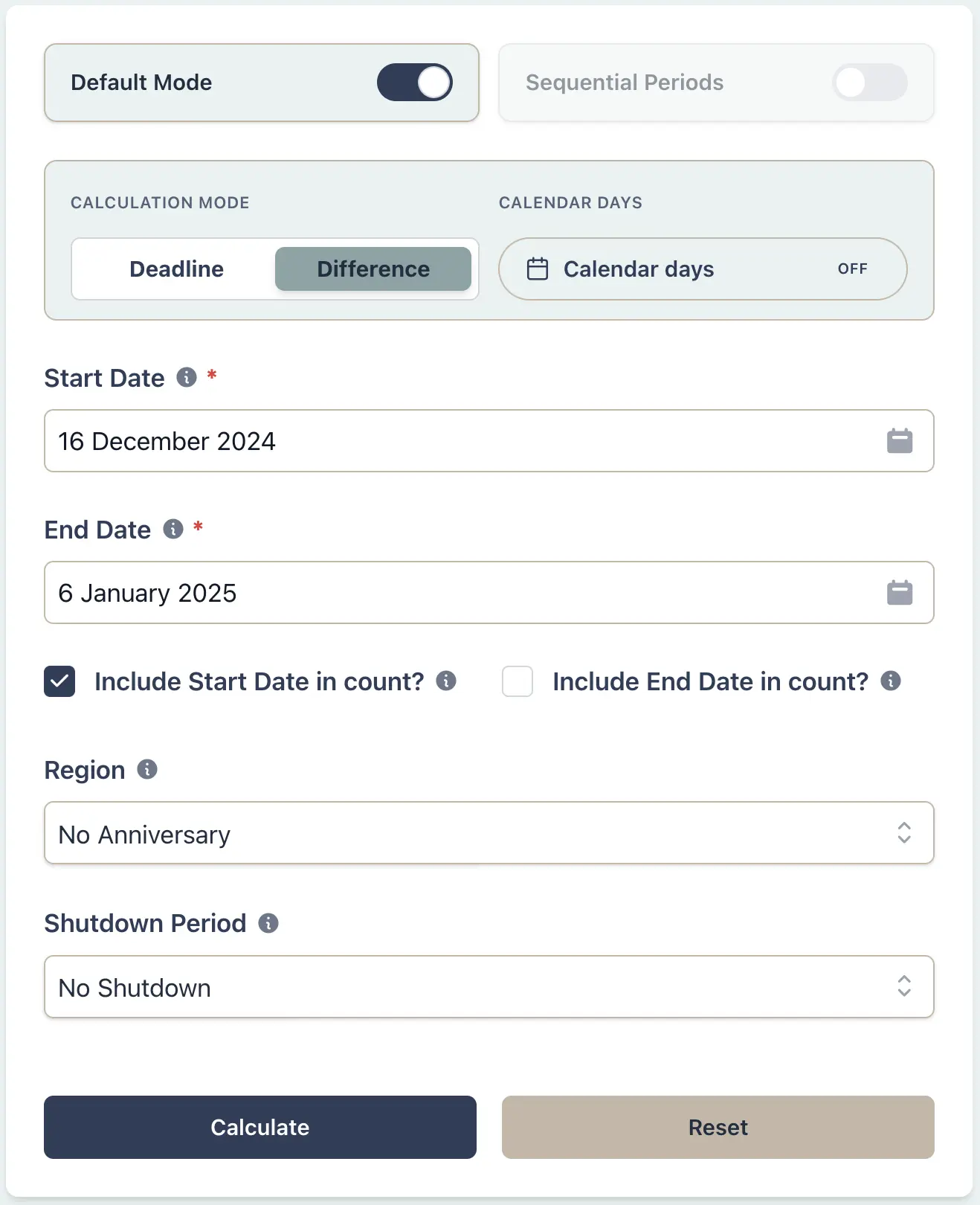

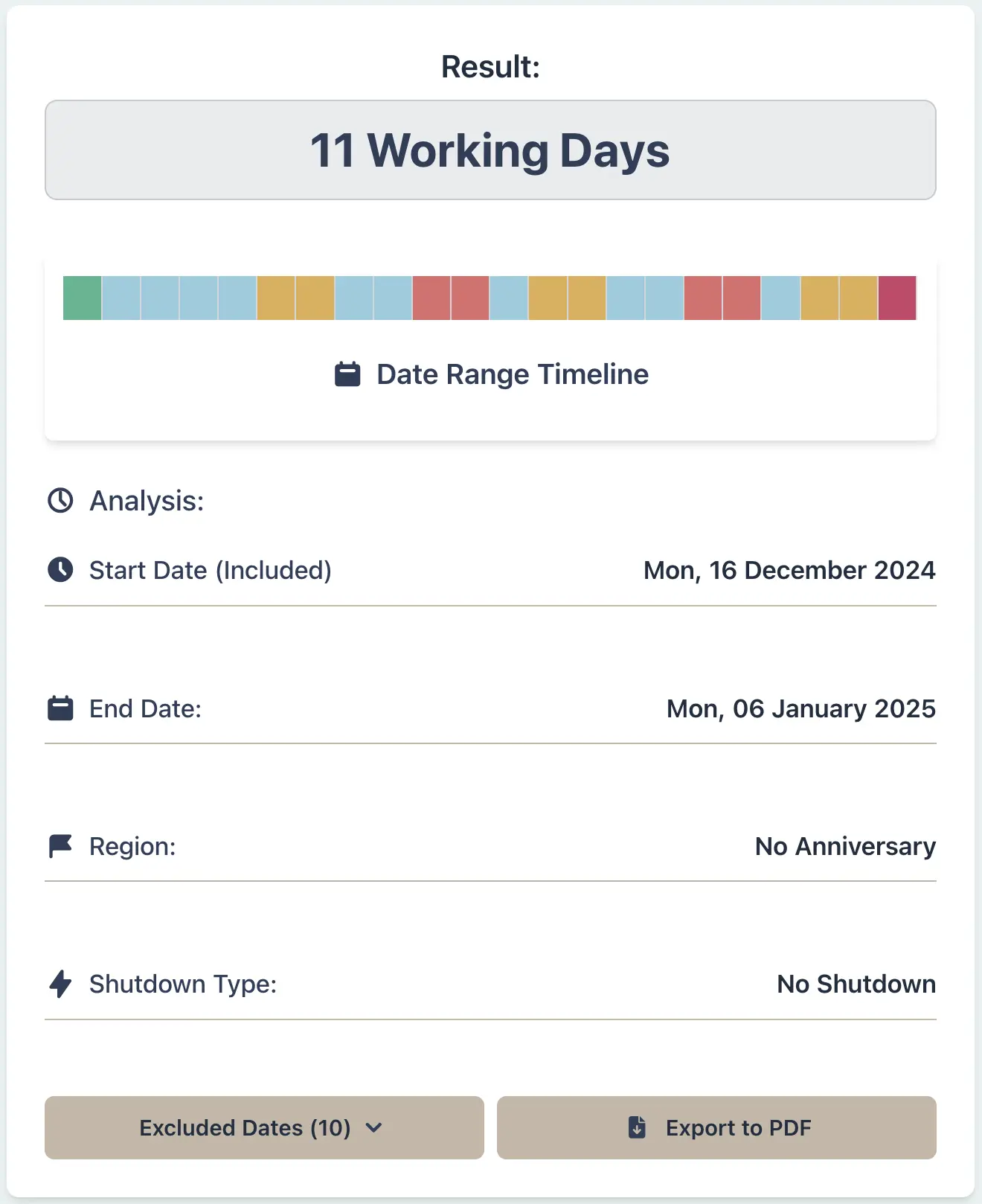

An employee has applied for leave from 16 December 2024 returning to work on 6 January 2025. As the HR manager, you need to calculate the exact number of working days within this period to accurately deduct from the employee's leave balance. This requires excluding weekends and public holidays.

Example Workflow

Result Example

For leave from 16 December 2024 (start date set to 15 January to include the first day of the holiday in the calculation) returning on 6 January 2025 (this date is excluded from the calculation), the number of working days, excluding weekends and public holidays, would be 11 working days.

Why This Matters

- •Ensure accurate leave balance tracking for employees

- •Exclude weekends and public holidays from calculations, ensuring fairness in leave deductions

- •Provide clear and transparent calculations to employees, fostering trust and compliance

- •Simplify HR administration and reduce disputes over leave calculations

Planner/Consultant:

Calculate RMA Submission Deadlines

Scenario

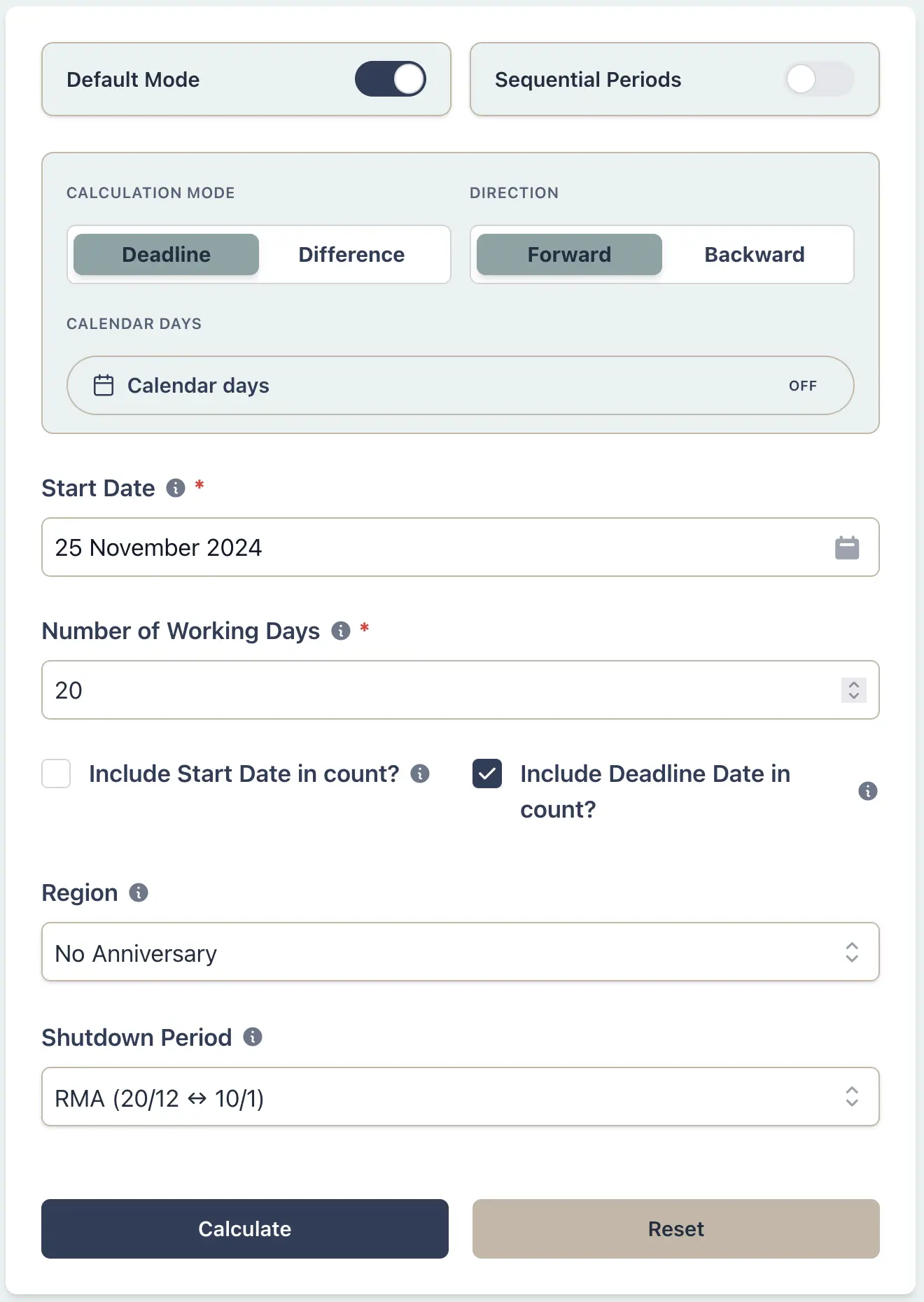

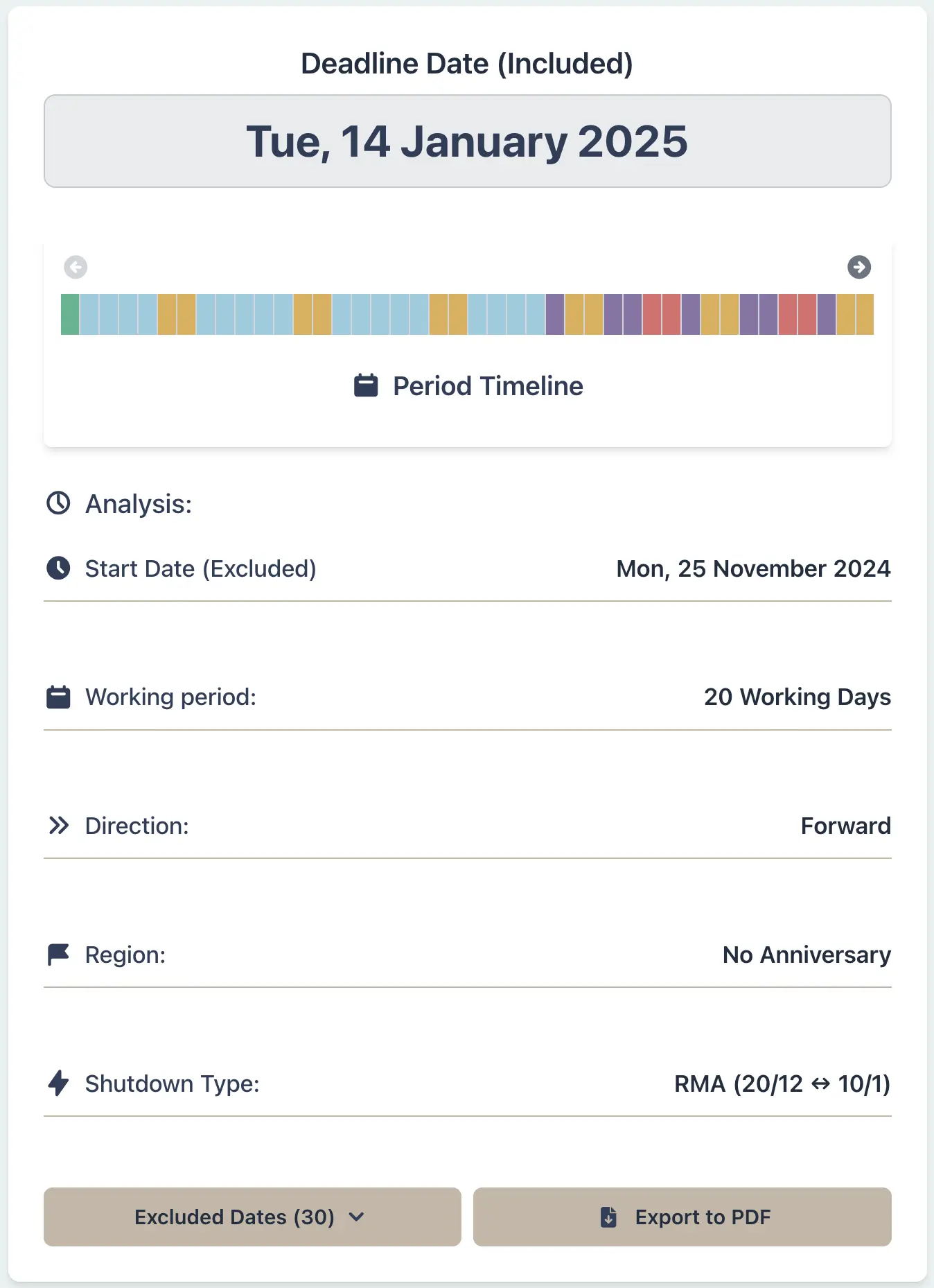

As an environmental planner, you've received notification of a resource consent application on 25 November 2024. Submissions must be lodged within 20 working days from the day after notification. You need to calculate the exact closing date for submissions, correctly applying the Resource Management Act's definition of 'working day', including the extended Christmas/New Year exclusion period (20 Dec - 10 Jan) and excluding regional anniversaries.

Example Workflow

Result Example

If notification is received on 25 November 2024, the submission period of 20 working days (excluding the notification day) closes on 14 January 2025, after accounting for // Updated start date and verified deadline weekends, statutory holidays, and the RMA exclusion period from 20 Dec to 10 Jan.

Why This Matters

- •Accurately determine RMA submission or processing deadlines

- •Correctly account for the specific RMA Christmas/New Year exclusion period

- •Avoid missing critical deadlines due to miscalculation

- •Ensure compliance with statutory timeframes under the RMA

Property Transaction:

Plan Due Diligence → Finance → Settlement

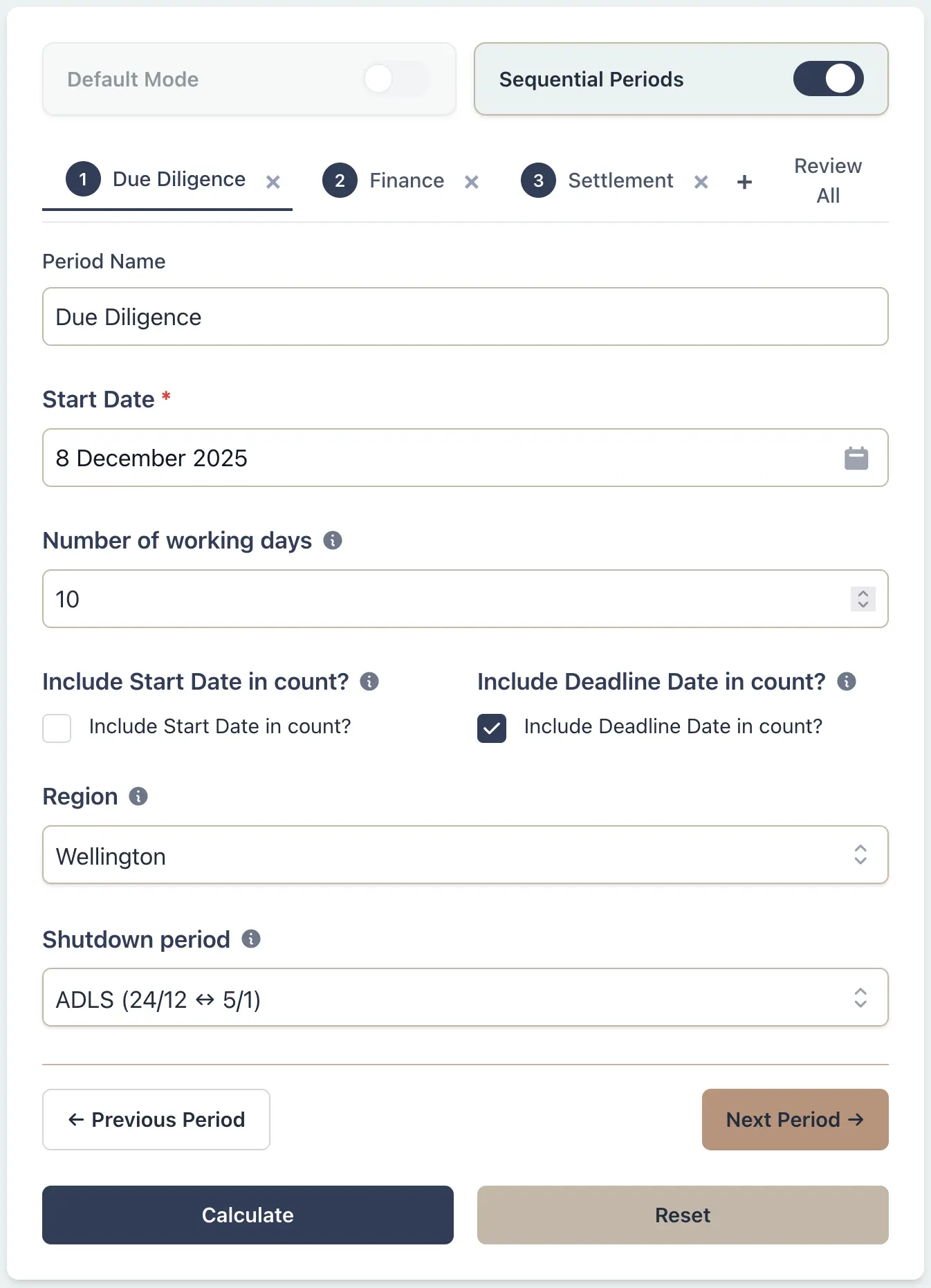

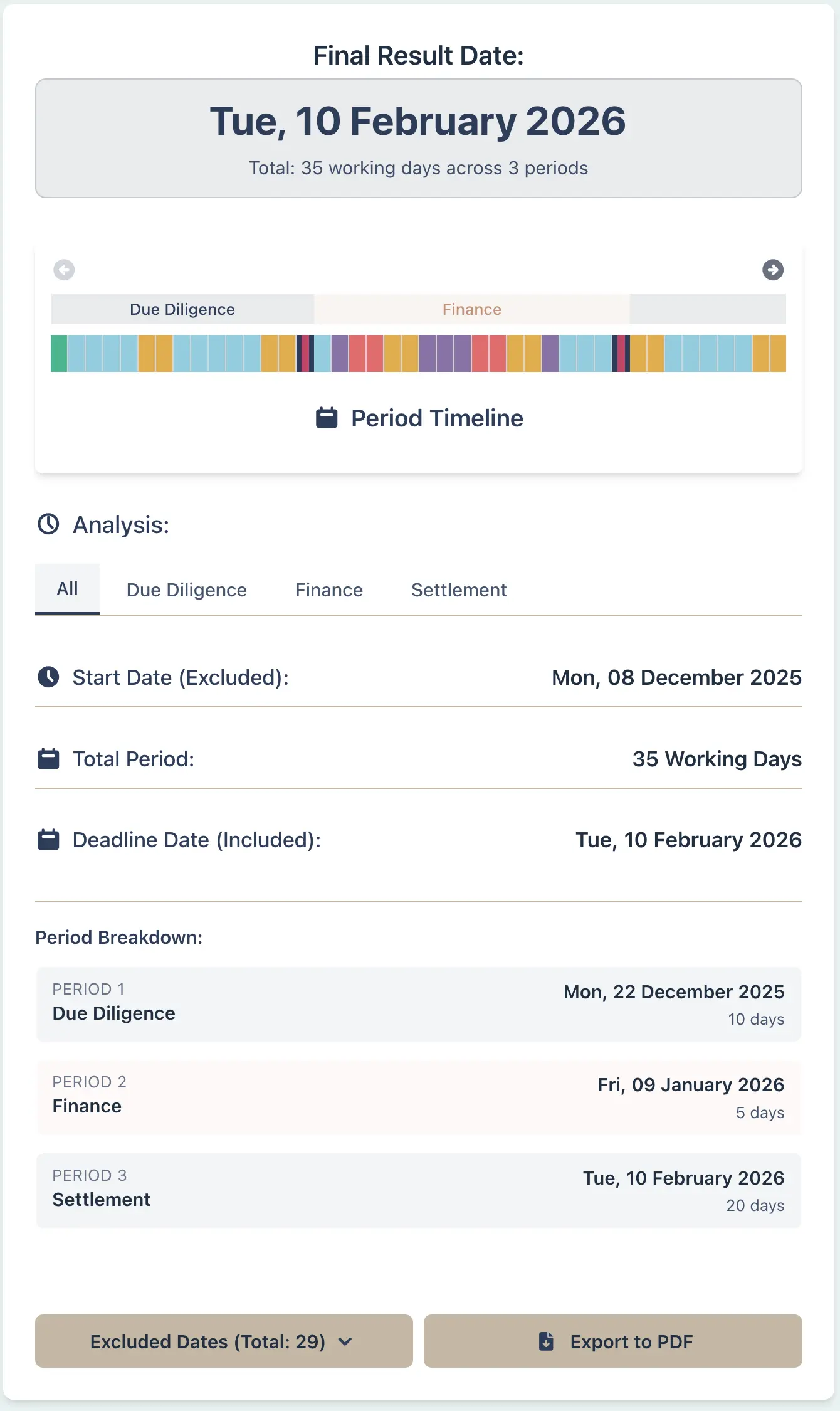

Scenario

A buyer and seller have agreed the offer on 8 December 2025. The contract requires a ten-working-day due diligence period, five working days for finance approval once due diligence clears, and a twenty-working-day runway to settlement after finance is approved. The transaction crosses the ADLS summer shutdown period (24 Dec - 5 Jan), and everyone involved understands the due dates for conditions and settlement.

Example Workflow

Result Example

Starting on 8 December 2025, due diligence would conclude on 22 December, finance approval would land on 9 January 2026 (after the ADLS shutdown), and settlement would complete on 10 February 2026. The calculator automatically excludes 24 Dec - 5 Jan from all periods. Wellington Anniversary (19 Jan) is also excluded, ensuring accurate scheduling across the summer holiday period.

Why This Matters

- •Keep every milestone in a transaction aligned without juggling separate calculations.

- •See exactly how the ADLS summer shutdown extends each period - no guesswork or manual counting.

- •Demonstrate to clients why their settlement date is 10 February, not late January.

- •Give all parties a single authoritative timeline PDF showing shutdown impacts across all stages.

- •Share the preset URL so everyone can verify the calculation independently.